End of May 2023 Update

Mixed May for Markets

Equities experienced a mixed month in May as technology-related stocks rallied while most other sectors remained flat or fell. The S&P 500 gained 0.43 percent while the Dow Jones Industrial Average fell 3.17 percent. The Nasdaq Composite led the way with a 5.93 percent return, supported by a surge in technology stocks due to a rise in investor enthusiasm surrounding AI at month-end.

These mixed results were supported by improving fundamental performance. Per Bloomberg Intelligence, as of May 31, 2023, with 98 percent of companies having reported actual earnings, the blended earnings decline for the S&P 500 in the first quarter was 3.07 percent. This is better than analyst estimates for an 8.06 percent drop in earnings at the start of earnings season. Despite better-than-expected results in the first quarter, this still marks two consecutive quarters with earnings declines for the S&P 500, signaling challenging business conditions at the end of last year and start of this year.

Technical factors were also supportive during the month. All three major U.S. indices finished May above their respective 200-day moving averages, marking five consecutive months with all three indices having finished above trend. The 200-day moving average is a widely monitored technical signal as prolonged breaks above or below this level can signal shifting investor sentiment for an index.

May was a more challenging month internationally, as both developed nations and emerging markets fell. The MSCI EAFE Index fell 4.23 percent in May while the MSCI Emerging Markets Index lost 1.65 percent. Technical factors were mixed internationally, with the MSCI EAFE Index finishing well above trend while the MSCI Emerging Markets Index fell below its trendline at month-end.

Fixed Income Pulls Back

Fixed income markets experienced losses in May, as rising rates pressured bond prices. The 10-year U.S. Treasury yield rose from 3.44 percent at the end of April to 3.64 percent the end of May. The Bloomberg Aggregate Bond Index lost 1.09 percent. Short-term yields rose notably, in part due to higher-than-expected inflation figures that led to increased market expectations for a potential rate hike at the Federal Open Market Committee (FOMC)’s June meeting.

High-yield fixed income also had a negative month. The Bloomberg U.S. Corporate High Yield Index lost 0.92 percent in May. High-yield credit spreads ended slightly higher than where they started, with spreads rising from 4.53 percent at the start of the month to 4.69 percent at month-end. High-yield spreads are still well below levels typically associated with recessions, so the relatively stable spreads during the month signal continued investor appetite for investing in higher yielding, riskier bonds.

Debt Ceiling Impact and Updates

The debt ceiling standoff dominated headlines throughout May due to worries of a potential U.S. government default in early June worrying investors across the globe. This rising concern about the federal government’s willingness to pay its bills on time was the major factor behind market turbulence.

The good news is that the Biden administration and House Republicans cut a deal at month-end that would suspend the debt ceiling until January 2025, effectively solving the issue for now and avoiding an unprecedented government default. While the delay means this issue will likely reemerge in 2025, the worst of the market risk from the latest debt ceiling standoff should be behind us.

Much like investor concerns surrounding the banking industry earlier in the year, the focus on the debt ceiling debate in May served as a reminder that real risks to markets remain despite economic improvements we’ve seen.

The Takeaway

· Rising concerns about the debt ceiling and a potential government default led to market pullbacks

· The deal to suspend the debt ceiling for two years at month-end put the market risks from this standoff largely behind us for now

Economic Updates Show Continued Growth

Economic updates released in May pointed toward continued growth. The April job report showed 253,000 jobs added, up from the 165,000 that were added in March. This is a strong result on an historical basis and shows the continued resilience of the labor market. We also saw an increase in job openings toward month-end, signaling continued high levels of demand for workers.

Consumer confidence and spending also improved, with both major consumer sentiment surveys improving more than expected in May. This was especially encouraging given the negative debt ceiling headlines throughout the month and highlights consumer resilience. The improved confidence may help support spending growth in the months ahead following a larger-than-expected increase in personal spending in April.

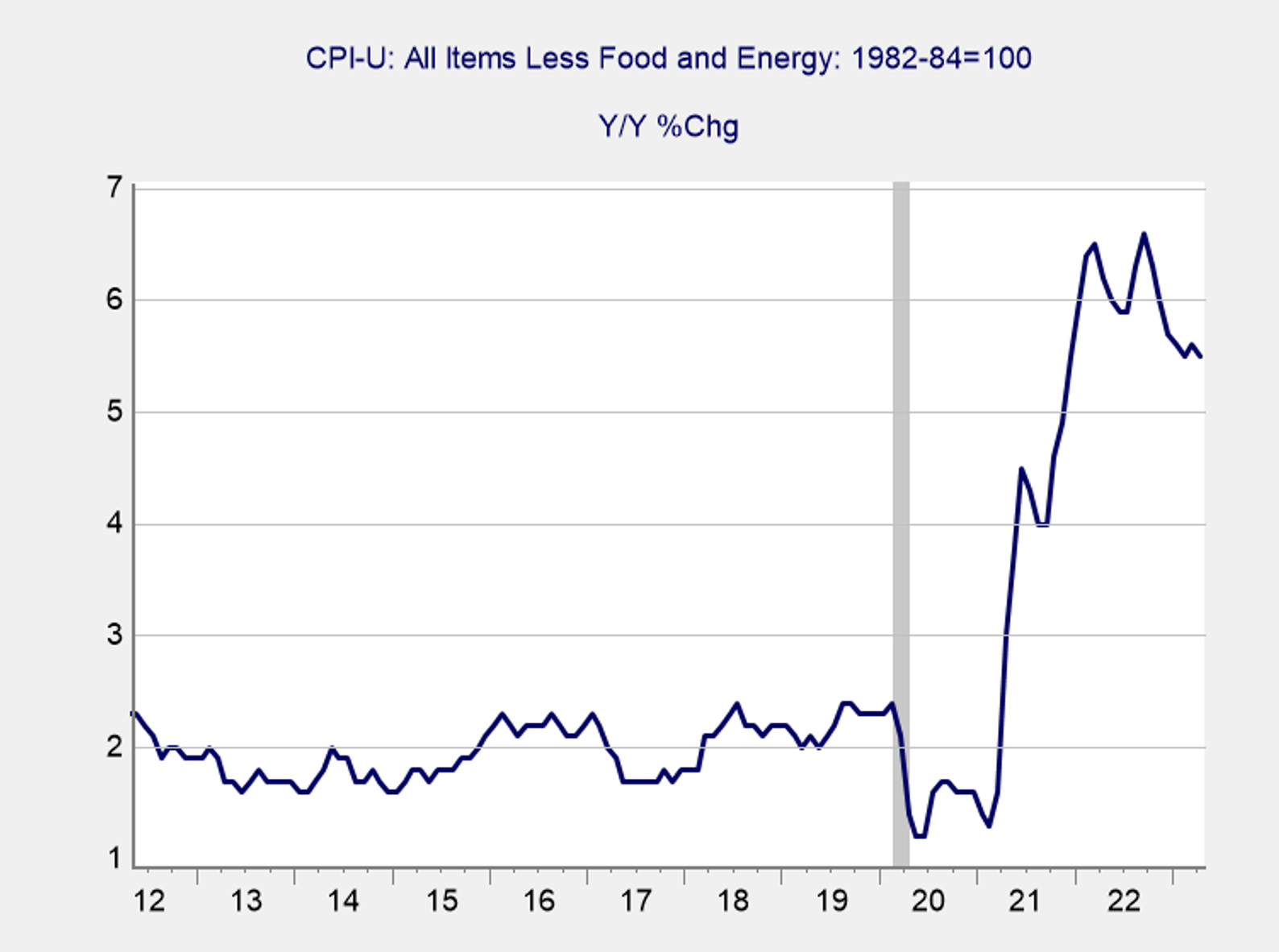

Not all of May’s economic updates were positive. While headline consumer and producer inflation continued to slow on a year-over-year basis in April, core inflation remained stubbornly high. As you can see in Figure 1, core consumer prices increased 5.5 percent on a year-over-year basis in April, which is an improvement from the recent high of 6.6 percent that we saw in September 2022, but still far too high on an historical basis.

Figure 1. CPI-U: All Items Less Food and Energy, Year-Over-Year % Change, May 2012–Present

Source: Bureau of Labor Statistics/Haver Analytics

The Federal Reserve (Fed) has signaled that it’s likely close to the end of its current rate hiking cycle; however, the higher-than-expected levels of inflation could support further rate hikes this year, which caused short-term yields to rise notably in May. All eyes will be on the June meeting to see if hotter-than-anticipated inflation reports released in May will be enough to support an additional rate hike of 25 basis points (bps).

May Reminds That Risks Remain

Uncertainty driven by the debt ceiling during the month was a reminder that markets face a landscape of swiftly shifting risks. While the immediate market threat from the debt ceiling standoff is likely behind us due to the month-end agreement, the episode increased uncertainty and weighed heavily on markets.

Looking forward, the Fed will continue to serve as a potential market risk, as we saw in May when rising expectations for a potential rate hike served as a headwind for markets. Economists and investors will continue to keep a close eye on the central bank in the months ahead due to the potentially disruptive effect that any changes to monetary policy can have on markets.

International risks remain as well, with the ongoing war in Ukraine serving as a reminder that geopolitical tensions are still elevated. China’s reopening efforts are also a potential risk to the global economy and markets given the country’s importance to global trade.

Finally, it’s always important to remember that unknown risks could also negatively affect investors in the months ahead.

The Takeaway

· The debt ceiling standoff led to increased uncertainty and market risk

· The Fed is the most pressing potential market risk, as the central bank could surprise investors with a rate hike at its June meeting

Outlook Remains Positive

Overall, economic and market updates in May were largely positive, with good news outweighing the bad. The debt ceiling standoff highlighted the outsized impact that political developments can have on markets, but the agreement to suspend the debt ceiling helped ensure that the worst is likely behind us.

The economy continued to show signs of solid growth during the month, supported by a strong labor market, improving consumer confidence, and continued consumer spending growth. While stubbornly high inflation is a concern, it’s important to note that sticky inflation is at least partially a consequence of strong economic expansion. While there’s still work to be done to get inflation back down to the Fed’s 2 percent target, healthy economic fundamentals are an encouraging sign that we’re not rapidly approaching a recession despite attempts from the Fed to slow the economy through higher rates.

While there are still very real risks that investors face in the short term, the most likely path forward is for continued economic growth in the intermediate to long run. The positive economic backdrop and decline in political risk should support markets in the months ahead.

With that said, the potential for further short-term uncertainty remains, and a well-diversified portfolio that matches investor timelines and goals remains the best path forward for most. As always, you should reach out to your financial advisor to discuss your current plan if you have concerns.

The Takeaway

· Updates in May were largely positive

· Risks for investors remain, but drops in political risk at month-end should support markets

· Over the long run the outlook remains positive, with potential for short-term setbacks

Disclosures: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. All indices are unmanaged and are not available for direct investment by the public. Past performance is not indicative of future results. The S&P 500 is based on the average performance of the 500 industrial stocks monitored by Standard & Poor’s. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The Dow Jones Industrial Average is computed by summing the prices of the stocks of 30 large companies and then dividing that total by an adjusted value, one which has been adjusted over the years to account for the effects of stock splits on the prices of the 30 companies. Dividends are reinvested to reflect the actual performance of the underlying securities. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The Bloomberg US Aggregate Bond Index is an unmanaged market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year. The U.S. Treasury Index is based on the auctions of U.S. Treasury bills, or on the U.S. Treasury’s daily yield curve. The Bloomberg US Mortgage Backed Securities (MBS) Index is an unmanaged market value-weighted index of 15- and 30-year fixed-rate securities backed by mortgage pools of the Government National Mortgage Association (GNMA), Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (FHLMC), and balloon mortgages with fixed-rate coupons. The Bloomberg US Municipal Index includes investment-grade, tax-exempt, and fixed-rate bonds with long-term maturities (greater than 2 years) selected from issues larger than $50 million. One basis point is equal to 1/100th of 1 percent, or 0.01 percent.

Smalley Investments is located at 213 E. St. Joseph Street, Lansing, MI 48933. Securities & advisory services offered through Commonwealth Financial Network, member FINRA/SIPC, a Registered Investment Adviser.

Authored by Brad McMillan, CFA®, CAIA, MAI, managing principal, chief investment officer, at Commonwealth Financial Network®.

© 2022 Commonwealth Financial Network®